When you consider Mark Walter’s net worth, it’s clear that his journey to becoming a billionaire is rooted in strategic investments and keen business insights. As the founder of Guggenheim Partners, he’s navigated various sectors, from finance to renewable energy, significantly impacting his wealth. His ownership of prestigious sports franchises adds another layer to his financial portfolio. But how did he manage to build such a diverse empire, and what does his wealth reveal about the current landscape of high-stakes investment? The answers might surprise you.

See also: Justin Pugh Net Worth: How Much Is the NFL Player Worth?

Early Life and Education

Mark Walter was born and raised in a modest environment, where his early experiences laid the foundation for his future success in finance and sports management.

Childhood influences instilled a strong work ethic, while his academic achievements showcased his commitment to learning.

These formative years shaped his ambitions, helping him develop the resilience and determination necessary to navigate the competitive landscapes ahead.

Career Path to Success

To understand Mark Walter’s impressive net worth, it’s essential to examine his career path.

You’ll find that his early career beginnings set the stage for his major business ventures and notable investments.

Each step he took contributed significantly to his financial success and influence in various industries.

Early Career Beginnings

Early in his career, Walter navigated the competitive landscape of finance and investment, laying the groundwork for his eventual success as a prominent figure in the sports industry. His career choices reflected a keen awareness of industry challenges, enabling him to adapt and thrive.

Walter’s success can be attributed to several key skills and strategies he developed:

- Strategic networking

- Analytical decision-making

- Financial acumen

- Risk management

- Continuous learning

Major Business Ventures

Building on his foundational skills in finance and investment, Walter embarked on major business ventures that significantly shaped his career and expanded his influence in the sports industry.

His strategic real estate investments and innovative technology ventures not only diversified his portfolio but also positioned him as a key player in emerging markets, showcasing his vision and commitment to sustainable growth.

Notable Investments Overview

Walter’s strategic investments in various industries haven’t only bolstered his financial success but also illustrated his acumen for identifying lucrative opportunities that align with market trends.

His approach emphasizes portfolio diversification and staying ahead of investment trends.

- Renewable energy

- Technology startups

- Real estate ventures

- Sports franchises

- Healthcare innovations

These choices reflect a visionary understanding of evolving markets.

Guggenheim Partners Overview

Guggenheim Partners has a rich history that shapes its current investment strategies and focus.

You’ll find that the company’s leadership team plays a crucial role in guiding its diverse financial services.

Understanding these elements will give you insight into how Guggenheim positions itself in the competitive market.

Company History and Background

Founded in 1999, Guggenheim Partners has evolved into a global investment and advisory firm known for its innovative financial solutions and strategic asset management. The company’s formation marked significant financial milestones, shaping its trajectory.

Key aspects include:

- Diverse investment strategies

- Strong client relationships

- Global reach

- Comprehensive asset management

- Commitment to innovation

These elements contribute to its impressive reputation in the financial world.

Investment Strategies and Focus

Guggenheim Partners employs a diverse array of investment strategies that focus on enhancing returns while managing risk across various asset classes.

By integrating value investing principles, they identify opportunities that align with long-term growth potential.

Their robust risk management framework ensures that investments are protected against market volatility, allowing you to pursue financial freedom while maintaining a balanced and strategic approach to wealth creation.

Key Leadership and Team

At the heart of Guggenheim Partners’ success lies a leadership team that combines diverse expertise and a shared vision for delivering innovative investment solutions.

Their effective team dynamics and varying leadership styles foster collaboration and adaptability, essential in today’s financial landscape.

- Diverse backgrounds

- Strategic decision-making

- Innovative problem-solving

- Strong communication

- Commitment to excellence

Major Investments and Ventures

Mark Walter has strategically invested in a variety of sectors, including sports, media, and technology, showcasing his diverse interests and business acumen.

His ventures encompass venture capital, where he identifies promising startups, and significant real estate projects that enhance his portfolio.

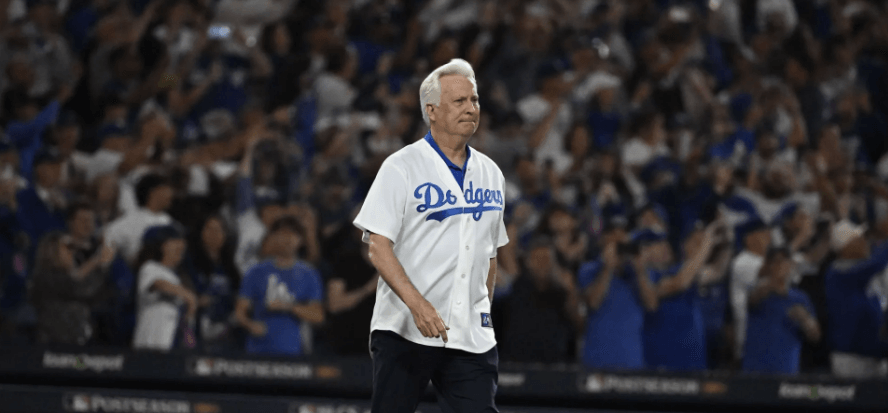

Sports Franchise Ownership

In the realm of sports franchise ownership, Walter’s strategic acquisitions demonstrate his commitment to leveraging his investment expertise in high-profile athletic teams. His understanding of franchise valuation and ownership dynamics positions him as a significant player in the industry.

Walter possesses expertise in revenue generation, which allows him to maximize the financial potential of the franchises he acquires.

His insight into market trends enables him to make informed decisions that align with the evolving landscape of sports entertainment.

Additionally, Walter’s strong negotiation skills facilitate favorable terms in acquisitions and partnerships, enhancing the overall value of his investments.

He maintains a focus on long-term growth, ensuring that his franchises not only thrive in the present but are also well-positioned for future success.

Philanthropic Endeavors

While many focus on his business ventures, Walter’s philanthropic endeavors reveal a commitment to social responsibility and community development.

His charitable initiatives aim to create lasting community impact, addressing critical issues such as education and health.

Current Net Worth Estimation

Estimates place Walter’s current net worth in the hundreds of millions, reflecting his successful ventures in finance and sports.

As you analyze current valuation trends and billionaire wealth dynamics, consider these factors:

- Investment portfolio diversity

- Revenue from sports franchises

- Real estate holdings

- Strategic partnerships

- Market fluctuations

These elements collectively highlight his financial acumen and adaptability in an ever-changing economic landscape.

Conclusion

As you delve into Mark Walter’s journey, you realize his wealth isn’t just about numbers; it’s a testament to vision and strategy.

With each investment and sports franchise acquisition, he’s not merely stacking riches but crafting a legacy.

Yet, the true measure of his success lies not in his bank account, but in how he shapes industries and inspires future leaders.

What’ll his next move be? Only time will reveal whether he continues to redefine the boundaries of wealth and influence.